Wall Street jittery over rising political tension in Catalonia

¡°Intensity and duration¡± of the current crisis key to determining impact on markets, players warn

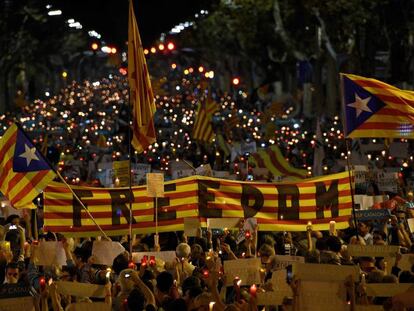

The ongoing political crisis between Madrid and Catalonia is a source of growing concern to investors, with the issue now causing as many sleepless nights as topics such as slowing growth in China, the uncertainty over Brexit or the nomination of the new Federal Reserve chair.

The anxiety over recent events in Catalonia can be felt in the reports by analysts, publications aimed at stock market investors and the specialized business press, all of which are busy explaining the situation for readers on the other side of the Atlantic.

¡°Chaos in Spain:¡± this is how CNN Money headlined its Thursday morning bulletin published shortly before Wall Street opened and after Spanish Prime Minister Mariano Rajoy decided to activate emergency rule in Catalonia in the coming days to halt the independence bid.

¡°It's the latest in a series of confrontations to result from a controversial independence referendum held earlier this month in the restive region,¡± said CNN Money in its bulletin.

The ¡°intensity and duration¡± of the current situation will be key in determining its effect on markets

References to the wrangle between the Spanish central government and regional powers in Catalonia have been coming thick and fast in the last three weeks. US business news channel CBNC said Spain¡¯s decision to use the so-called ¡°nuclear option¡± by invoking Article 155 ¨C a provision that allows the central government to take direct charge of Catalan affairs ¨C was expected. It noted Madrid was attempting to rein in the independence movement, but warned about formal rupture with Catalonia if Rajoy¡¯s government failed to engage in talks.

Meanwhile, in a note to clients, investment bank JPMorgan said: ¡°It is difficult to predict the intensity with which the central government will respond when it applies Article 155,¡± adding it hoped ¡°this will be done in a gradual manner. The banking giant went on to note that possible measures included trying Catalan leaders in court and temporarily suspending their functions.

On the Wall Street floor, the general consensus is that the ¡°intensity and duration¡± of the current situation will be key in determining its effect on markets.

Canadian credit rating agency DBRS also points out that the crisis coincides with a period of robust growth in Spain, with performance of the country¡¯s economy outstripping its EU partners. The trend should continue in coming years, the firm notes, but warns the independence issue could derail that growth.

Fellow credit ratings firm Moody's continues to believe a split between Catalonia and Spain is ¡°improbable¡± but warns the independence movement ¡°creates significant risks¡± such as potential consequences for the Spanish economy and financial system.

The euro is up 12% against the dollar this year, but experts note that the independence issue could throw a wrench in the works

There are also calls for a de-escalation in the dispute between Madrid and Catalonia: investment management firm Neuberger Berman said it is time to ¡°take a deep breath,¡± and a step back, to avoid the adoption of extreme measures that could jack up tension. ¡°A negotiated solution must be found. This situation doesn¡¯t benefit anyone,¡± the firm¡¯s analysts believe.

Market watchers also highlight that political uncertainty in Spain could create volatility on the currency markets. The euro is up 12% against the dollar this year, but experts note that Catalonia comprises 20% of the Spanish economy and the independence issue could throw a wrench in the works.

¡°A fall in the euro as a reaction cannot be ruled out,¡± said analysts ACLS Global, although they noted that the impact would be limited. But it would be another story if ¡°we see people in Belgium or northern Italy with Catalan flags saying we want to be next,¡± the firm warned.

English version by George Mills.

Tu suscripci¨®n se est¨¢ usando en otro dispositivo

?Quieres a?adir otro usuario a tu suscripci¨®n?

Si contin¨²as leyendo en este dispositivo, no se podr¨¢ leer en el otro.

FlechaTu suscripci¨®n se est¨¢ usando en otro dispositivo y solo puedes acceder a EL PA?S desde un dispositivo a la vez.

Si quieres compartir tu cuenta, cambia tu suscripci¨®n a la modalidad Premium, as¨ª podr¨¢s a?adir otro usuario. Cada uno acceder¨¢ con su propia cuenta de email, lo que os permitir¨¢ personalizar vuestra experiencia en EL PA?S.

?Tienes una suscripci¨®n de empresa? Accede aqu¨ª para contratar m¨¢s cuentas.

En el caso de no saber qui¨¦n est¨¢ usando tu cuenta, te recomendamos cambiar tu contrase?a aqu¨ª.

Si decides continuar compartiendo tu cuenta, este mensaje se mostrar¨¢ en tu dispositivo y en el de la otra persona que est¨¢ usando tu cuenta de forma indefinida, afectando a tu experiencia de lectura. Puedes consultar aqu¨ª los t¨¦rminos y condiciones de la suscripci¨®n digital.